Leave a Legacy: Planned Giving through NDI’s Silver Star Society

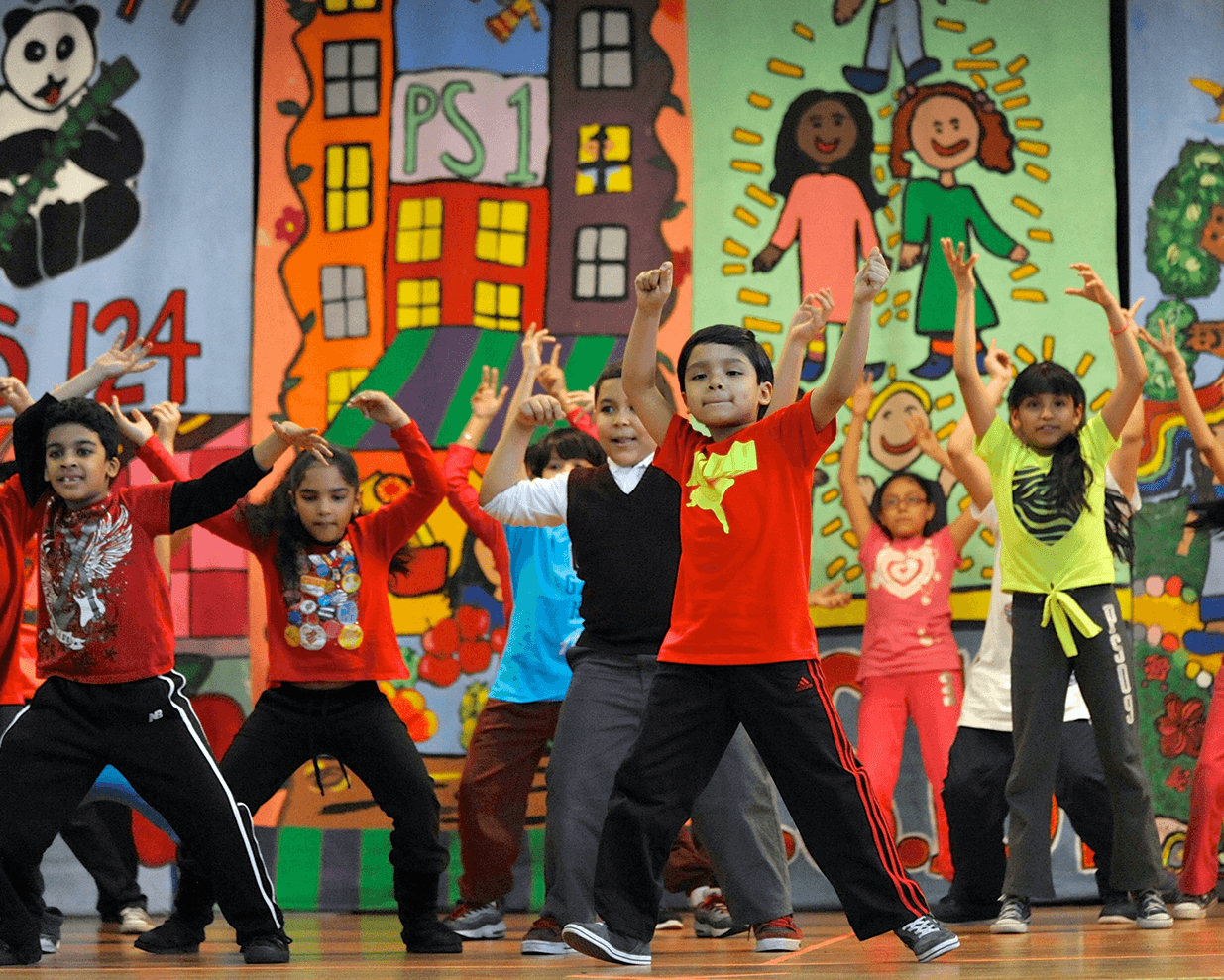

NDI’s Silver Star Society honors the generosity of individuals who have included NDI in their wills or estate plans. Bequests provide future generations of children with free arts education programs.

When you include NDI in your estate plans, you ensure that thousands of children each year will have their lives transformed through the arts.

In addition to special invitations throughout the year and ongoing recognition of your dedication to NDI, as a member of the Silver Star Society, you will have the deep satisfaction of knowing you are fostering NDI’s commitment to building vibrant arts and learning communities where children work together toward common goals, reach new heights of achievement side by side, and fulfill dreams they never thought possible.

“I have donated to NDI for over 30 years, so it made perfect sense for me to join NDI’s Silver Star Society to leave a legacy to the organization. I am happy to know that I can help NDI to provide children with formative and joyful experiences for years to come.”

-Gayle Griffith, Silver Star Society Member

Your bequest will provide future generations of children with free arts education programs. Example wording to share with your attorney: “I give (bequeath, devise) ___________ to National Dance Institute, Inc., of New York, NY, to be used for its general purposes.”

Naming NDI as a beneficiary of life insurance proceeds will make it possible for children to develop skills vital to their success and development, with the added advantage of lowering estate tax for your heirs.

Create an income stream now with a charitable annuity, while fortifying tomorrow’s students. Or support today’s NDI children and direct residual assets to your heirs later through a charitable remainder trust.

Earned interest from stocks, bonds, and mutual funds provides school children with engaging instruction in dance and music, while also avoiding capital gains for your heirs.

Artwork, personal residences, and other tangible valuables can fill the arts education gap, and offer a charitable tax credit.

Supporters who are at least 70.5 years old can harness the power of the arts immediately by giving directly from qualified retirement plans.

Become a member of NDI’s Silver Star Society and help future generations of children reach for the stars. Contact our team:

- General Giving: development@nationaldance.org • (212) 226-0083

- Director of Individual Giving: Brooke Berescik-Johns at bjohns@nationaldance.org

“The biggest gift we can leave to the generations of learners who will follow us is that of a complete education, and an education is only whole when the arts are a part of it.”

–Jacques d’Amboise

National Dance Institute is a 501(c)(3) nonprofit organization. Tax ID: 13-2890779.

217 West 147th Street, New York, NY 10039